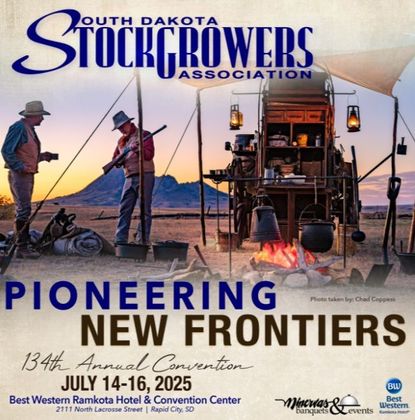

2025 Convention Registration is open now!

Early Bird Registration Ends July 7, 2025

Click the image below to page the highlights of the 2025 SDSGA Convention today on your Smartphone or PC/Mac!

Stockgrowers History and Eligibility

The Stockgrower's Association building is eligible for.....

.....The National Register based on both Criterion A and C. The

South Dakota Stockgrower’s Association has played a significant role in the economic and cultural development of Rapid City, the Black Hills, the state and the west. In addition to the building’s association with this important organization, the Stockgrower’s Building is a unique and tempered expression of Mid Century Modern design aesthetics in theMidwest and an icon of community identity. MORE

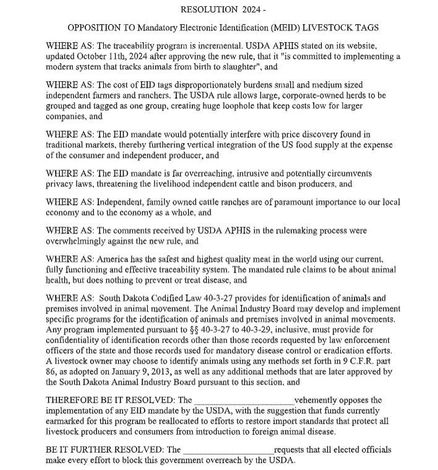

Keeping You Informed on the Policies and Issues